The GOP Trying Trump-Style Tax Cuts in Kansas. What A Mess!.

WASHINGTON — Republicans and Democrats are getting ready for a fight over of dollars in tax cuts. But the first battleground is thousands of miles away in Kansas, where the failure of a similar plan has become a rallying cry for opponents.

Earlier this year, Kansas' GOP-controlled legislature voted to effectively end a five-year push to slash taxes on individuals and businesses after revenues plummeted and forced deep cuts and tax hikes elsewhere. In doing so, they overturned a veto by Gov. Sam Brownback, a Republican who drew national attention in conservative circles when he launched his ambitious tax-cut program in 2012.

For Democrats, Kansas has become Exhibit A in their prosecution of the Trump tax cuts. It's routinely cited as evidence the new GOP proposal won’t grow the economy or pay for itself, and that proposed business tax reduction similar to Brownback’s will create a new loophole for wealthy individuals to exploit.

"It was a real-life experiment in a Republican state, similar to what President Trump announced," Minority Leader Chuck Schumer, D-N.Y., said on the Senate floor. "It added so much money to their deficit over four years that they have had to figure out ways to raise taxes now, just as Ronald Reagan did in 1986."

Schumer is one of many Democrats to bring up the state's budget woes in recent weeks, giving Kansas folklore status among progressives. Sen. Bernie Sanders, I-Vt., has highlighted the Kansas tax cuts throughout the year, which he said "devastated the state," and tweeted his congratulations when the state legislature reversed them.

Democrats aren't the only ones digging into Kansas either. Academics have studied the state's unique experience for policy clues. Some small-government conservatives see lessons worth salvaging even as they disagree with Democrats' broader interpretation. And the players in Kansas are weighing in as well, with Republicans on both sides of the tax fight debating where things went wrong.

What happened in Kansas

Like Brownback, Trump is proposing simplifying and lowering individual tax rates. Like Brownback, he’s pushing an unusual tax cut for business owners that critics say opens up a major loophole. And, much more than Brownback ever did, Trump's team is promising that explosive growth will make up for the cost of their cuts.

Brownback pitched his plan as a test of conservative policy. First, the state would cut income taxes (the top rate went from 6.45 percent to 4.9 percent) and eliminate taxes entirely on pass-through income for business owners.

Brownback pitched his plan as a test of conservative policy. First, the state would cut income taxes (the top rate went from 6.45 percent to 4.9 percent) and eliminate taxes entirely on pass-through income for business owners.

If, as the governor predicted, the cuts attracted new businesses, added jobs and boosted funding for schools and local governments, then income tax rates would decrease even further as part of a "March to Zero" that would end them entirely.

"The tax plan was basically an experiment in supply-side economics," said Heidi Holliday, executive director at Kansas Center for Economic Growth, which opposed the cuts. "We were promised it would be 'a shot of adrenaline' into the Kansas economy."

Things, however, did not go according to plan.

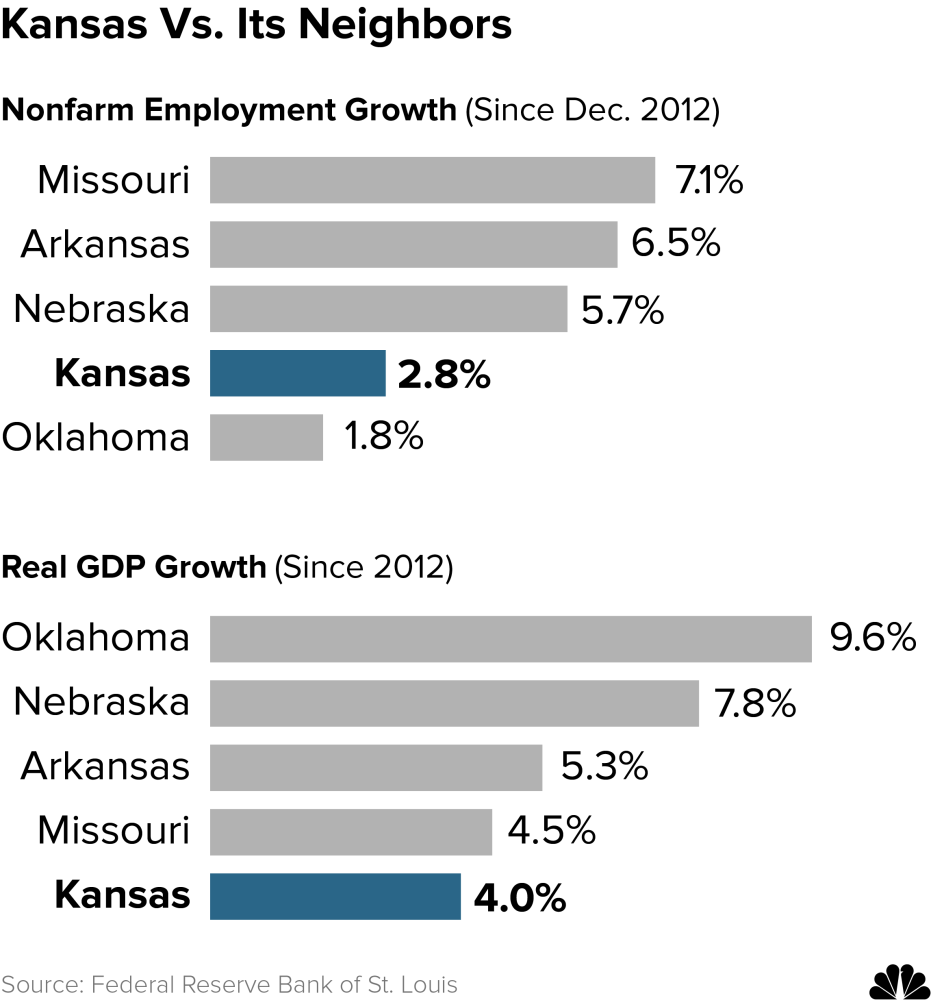

Over the next five years, state and local governments battled over a dwindling revenue supply, including a roughly $700 million drop-off in the first year. Job growth, meanwhile, lagged behind the national average and neighboring states.

Financial ratings agencies, unimpressed with boasts of an impending boom, downgraded the state's debt in 2014. Standard & Poor's blamed Kansas'"structurally unbalanced budget" while Moody's also cited the income tax cuts in lowering its outlook.

Economic growth in Kansas and surrounding states. NBC News

The issue increasingly divided the GOP. Brownback won a narrow victory over a Democratic challenger in 2014, an otherwise strong Republican year, while promising his tax cuts needed more time but would create 100,000 new jobs and a rebound in revenue.

But the budget problems persisted while economic growth remained modest.

Facing growing calls from his own party to reverse the income and business tax cuts, Brownback pushed for alternative means to plug the budget gap. Over several years, the legislature extended and hiked a temporary sales tax and added taxes on cigarettes and alcohol, among other measures.

Facing growing calls from his own party to reverse the income and business tax cuts, Brownback pushed for alternative means to plug the budget gap. Over several years, the legislature extended and hiked a temporary sales tax and added taxes on cigarettes and alcohol, among other measures.

"The empirical evidence was clear that revenues fell off a cliff, especially individual income tax revenues," Kenneth Kriz, who has studied the plan's impact as director of the Kansas Public Finance Center at Wichita State University, told NBC News. "There was just no way they could make up that much lost revenue."

The debate fractured the state's Republican Party. In 2016, a wave of moderates took office promising an end to the tax experiment and more money for schools, some of which had announced they were shortening the academic year in response to a lack of funding.

"We have three parties in our state,” said GOP state Sen. Barbara Bollier, a former state representative who won her current seat in 2016. "We have conservative Republicans, moderate Republicans and Democrats."

Bollier, who falls into the moderate camp, opposed Brownback’s plan from the beginning. She gained allies and converts as the backlash grew. Eventually, it was enough to override Brownback’s veto in June with support from both the Republican Senate majority leader, who had initially backed the tax cuts, and the Republican House speaker.

Brownback complained they had taken "a big step backwards" and blamed factors out of the state's control for the shortfalls.

"Everything can be traced back to this governor and this ideology and this idea that if you cut, cut, cut and don’t bring revenue in it will all work," Bollier said. "Well, it ain’t working."

No comments